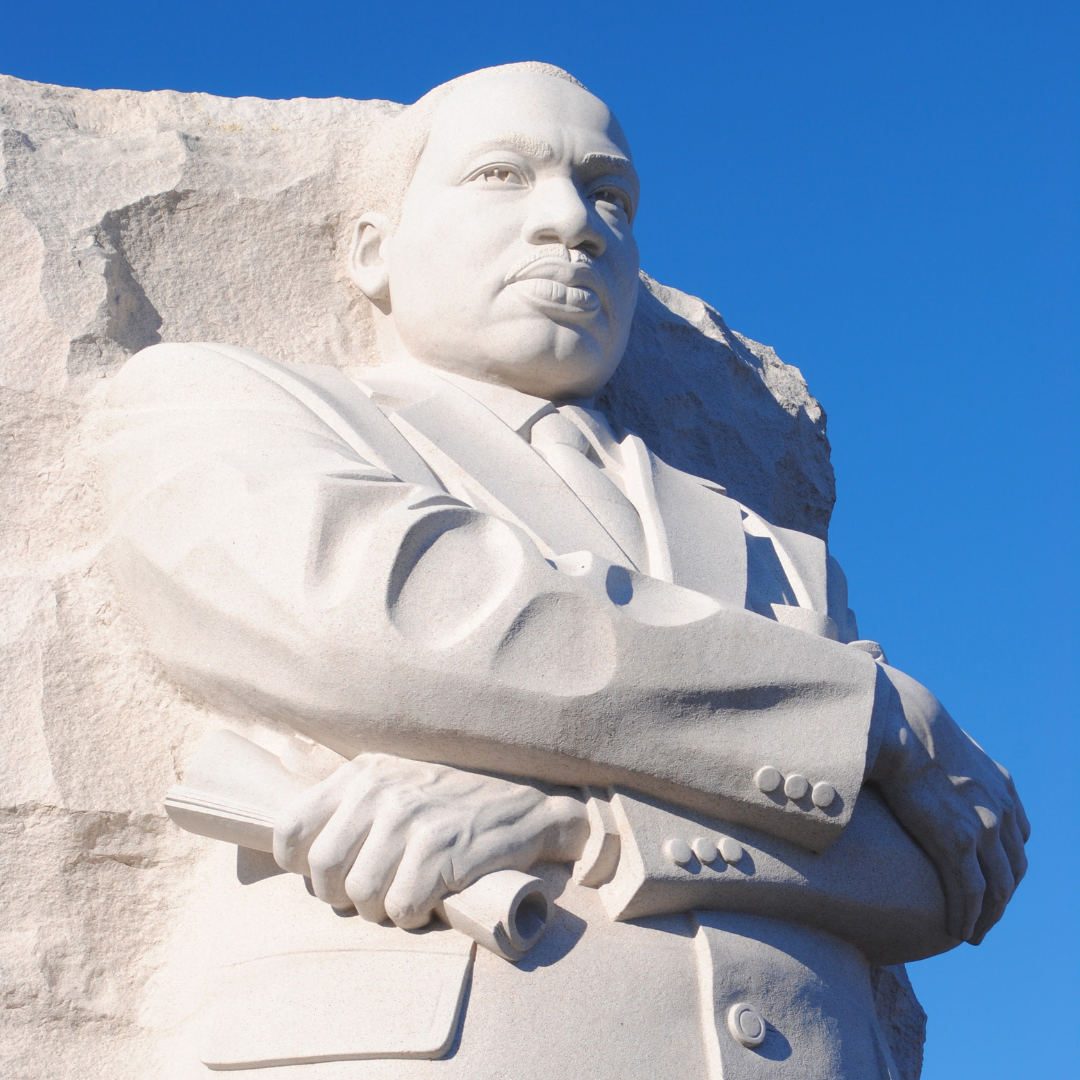

Honoring Dr. Martin Luther King Jr.: History, Hope, and the Work That Continues

/Each year on Martin Luther King Jr. Day, we pause to reflect on the life and legacy of Martin Luther King Jr.—not only as a historical figure, but as a moral compass whose words and actions …

Read More